After 2022’s bond rout, 2023 was a wonderful time for fixed income investors. High yields as well as a variety of other factors sent many investors into attractive bonds. With lower issuance, the prices for many fixed income asset classes surged. This included the municipal bond sector. And with that, total returns—yield plus capital appreciation—was one of the best on record.

But so far, 2024 has been a bust. Municipal bonds have sputtered to a slight loss.

The question is whether or not investors should be worried. Will the new year be another one of losses for muni investors? The answer may be a resounding no.

A Negative Return

Like many sectors of the bond market, municipal bonds spent much of last year lower as the Fed raised interest rates. Municipal bonds were hit hard, especially the longer-dated and higher-duration ones. All of that changed as the Fed paused its monetary tightening process.

Drawn by their high-tax-free yields, investors flooded the municipal bonds market. The Bloomberg Municipal Bond Index managed to rally an impressive 8.82% during November and December, allowing the index to hit a 6.40% gain for the entire year. This was one of the best returns for the sector in nearly 40 years and outpaced the Bloomberg U.S. Treasury Index by over two full percentage points.

However, lately, the muni sector seems to be struggling. And in fact, it is showing a loss on the year to date. The sector managed to produce a negative 1.05% in January. A slight uptick in February managed to push the total return for the sector to a 0.8% loss. So far this March, results have been similar with a slight negative return.

The reasons for the downturn come down to yield and supply/demand dynamics.

Investors are typically drawn to the municipal bond market due to their high after-tax yield. But as investors have flooded the sector, those yields are down. According to Bloomberg, at the end of October—and before the year-end rally—top-rated AAA municipal bonds maturing in 10 years yielded 3.63%. Today, that number is closer to 2.53%.

Second, issuance has caught up with supplies. Many states and local governments have pared back issuing new debt since interest rates have surged. What has been issued has roughly matched maturing debt. Many big buyers of muni debt—endowments, insurance funds, pensions—are rolling over their municipal bond debt into new munis. With supplies matching this demand, capital gains have been slim.

Looking Ahead

The question is: What comes next and should investors be worried that negative returns will persist? Could we be witnessing a repeat of 2022’s negative returns? The answer is most likely not.

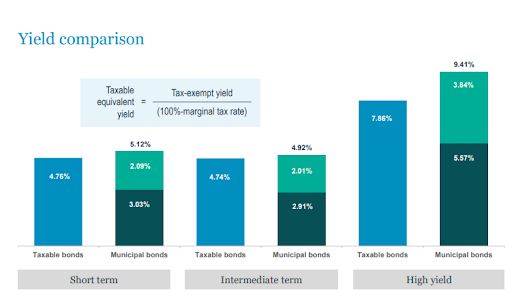

For starters, yields on munis are still very attractive on an after-tax basis. Uncle Sam will give muni investors a break on federal taxes and many states offer similar breaks. Those after-tax yields are still significantly more than other investment-grade bonds such as corporates and Treasuries. This chart from Nuveen shows the yield difference across various durations.

Source: Nuveen

At the same time, the Biden Administration has begun policy work to raise taxes on various fronts. Many analysts believe this would help the sector for future gains as more investors look toward munis to save on taxes.

Meanwhile, demand is finally expected to outstrip supply in the near term. Investors looking to reposition large cash positions are expected to be drawn to higher-yielding municipal bonds. While muni issuance is expected to grow, the weird current environment with ‘higher for longer’ rates is still expected to keep that issuance tepid.

Speaking of that cut, historically munis have performed very well after the first cut, even if the Fed pauses after it. After the first cut, muni bonds have managed to experience an average 7.1% 12-month forward total return.

The backdrop to this is a relatively stable municipal market environment. States and local governments have seen a slight increase in their revenues. Meanwhile, rainy-day funds are still above historic norms. Credit ratings for a variety of municipal bonds have also increased. This backdrop provides still lower volatility. As such, munis are poised to perform well in case of economic downturn or recession, again boosting their total return potential.

Good Gains Ahead

With all of the positives, municipal bonds can still generate some strong total returns in the year ahead. The key is to temper expectations. The last two years were sort of an anomaly with the normally sleepy muni sector. Historically, the sector has been about collecting wonderful tax-free yields and maybe pulling in some low capital gains. After the bond market reset and the current environment, investors should expect that or slightly better going forward.

That doesn’t mean the asset class isn’t worth owning, however. The tax advantages and low volatility make it a stealer choice for portfolios.

Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their YTD total return, which ranges from -0.3% to 0.3%. They have expense ratios between 0.05% to 0.65% and have assets under management between $930M to $34B. They are currently offering yields between 1.7% and 3.4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.8B | 0.3% | 3.2% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | 0.1% | 3.4% | 0.35% | ETF | Yes |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29B | -0.1% | 3.1% | 0.05% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | -0.1% | 1.7% | 0.20% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | -0.2% | 2.1% | 0.07% | ETF | No |

| MUB | iShares National Muni Bond ETF | $34B | -0.3% | 3.0% | 0.05% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $933M | -0.3% | 2.9% | 0.19% | ETF | Yes |

For investors, the negative returns for muni bonds can seem disheartening, particularly after last year’s surge. However, investors shouldn’t fret. There is still plenty of potential for the asset class. Ultimately, their high after-tax yields will be in demand going forward and that should help on the returns front.

The Bottom Line

Municipal bonds have started the year with a loss after a record year. For investors, this has raised concerns. However, investors shouldn’t worry. Munis still have plenty of juice left in the tank to perform well for portfolios. Adding them still makes sense.