For some investors, the sole purpose of investing in municipal debt is to take advantage of the tax-free income, diversified portfolio and limited risk exposure that is often higher in the world of corporate debt than municipal debt.

These ideas and advantages of municipal debt may not be wide-spread or applicable to every investor equally – for example, the tax-free benefit can vary from investor to investor depending on their income tax brackets, and for some investors taxable investment instruments may present more of a lucrative option than municipal debt.

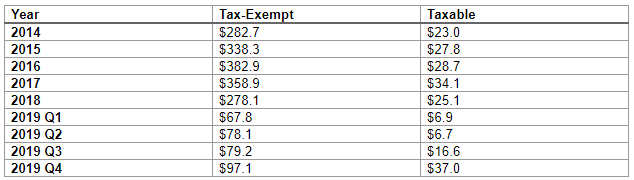

Furthermore, when municipalities issue taxable debt, it’s either for a purpose/project that may not allow them to issue tax-free debt to raise capital. Taxable municipal debt issuance makes sense, at a given particular time, after gauging an investor’s interest and appetite. Historically, taxable municipal debt issuance has been close to 10% of the entire tax-exempt municipal debt. For instance, in 2018, the taxable debt issuance was $25.1 billion dollars, whereas the tax-exempt debt was roughly $278.1 billion. However, 2019 was record-breaking for taxable municipal debt issuance.

In this article, we will take a closer look at the world of taxable municipal debt and how it fits into your portfolio.

Be sure to check out our Education section to learn more about municipal bonds.

Taxable Municipal Debt Issuance Breaking Records In 2019

The year 2019 saw a huge surge in taxable municipal debt issuance in the United States – especially the last three months of the year – with municipalities issuing over $67 billion in taxable debt. Comparatively, the table below shows the difference between taxable and tax-exempt issuance in the United States over the years including the spike in 2019. Furthermore, much of this spike can be attributed to the last three months of 2019, which issued over $37 billion of taxable debt, while the first three quarters of the year issued about $30 billion.

Here are some of the reasons attributed to the increase in taxable debt in 2019.

The Elimination of the Popular Advance Refunding in 2017 Tax Cuts

Before we discuss the impact of eliminating the advance refunding option for U.S. municipalities, it’s important to understand the process of refunding debt prior to its maturity to, for example, capitalize on interest rate savings, etc.

The Tax Cut and Jobs Act of 2017 removed the tax exemption from advance refunding of municipal bonds, which allowed municipal organizations to borrow money more than 90 days ahead of the nearest call or maturity date to pre-refund the future principal payment. In doing so, the municipality would take the proceeds from the new bond issuance and put it in an escrow account generally secured by U.S. Treasury or Agency securities, which have the highest credit quality.

As a result, the underlying security now carries the same credit risk as the underlying U.S. Treasury or Agency securities. Before the Tax Cut Act, obligors could issue these advance refunding bonds as federally tax-exempt. After the Tax Cut Act, obligors were no longer able to obtain a tax-exemption on these issues, which means they have to pay a higher interest cost for advance refunding a bond, thereby reducing the incentive.

Don’t forget to check out the implications of the Tax Cuts and Jobs Act here.

Low Interest Rate Environment and Advanced Refunding of Tax-Exempt debt

However, because the interest rates have been relatively low, municipalities still saw value in advance refunding their tax-exempt debt with taxable debt, because the new tax laws didn’t allow municipalities to issue tax-exempt debt for this purpose. The low interest rates fostered a perfect environment for municipalities to issue taxable municipal debt and still capture savings.

The Federal Reserve left the target range for its federal funds rate unchanged at 1.5-1.75 percent on January 29, 2020, as expected, saying the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions and inflation returning to the 2 percent objective. In addition, the Fed signaled rates will likely stay unchanged for a while. This means that taxable advance refunding will likely continue, and some professionals believe that it may surpass the $100 billion mark in 2020.

The chart below shows the fed funds rate changes over the past few years. It can also be seen, contrary to popular opinion in 2018-2019, that the Fed decided to cut rates in 2019.

Growing Interest From a Wide Variety of International Investors

The significant increase in taxable municipal debt is also available to meet the global demand for U.S. municipal debt. Unlike U.S. investors, for international investors the tax-exempt or taxable status of municipal debt is irrelevant. In addition, the tumultuous nature of the international markets, given the trade wars, Iran conflict and now coronavirus, investors often prefer less risky investments with consistent returns, and municipal debt or Treasuries tend to be a safer option.

The overall global fear of a recession and the recent market corrections due to the spread of coronavirus indicates that people prefer safer investment options over equities. In addition to the global uncertainties, “Taxable sales create a balance in the marketplace, in a sense, by letting municipal issuers explore different channels of distribution,” said Hector Negroni, founder of Fundamental Credit Opportunities, “It demonstrates that our marketplace can be expanded beyond the narrow profile of tax-exemption and broadening demand ultimately improves efficiency.”

Check out our previous take on the implications of European and Japanese investments for the U.S. muni market here.

The Bottom Line

The presence of taxable municipal debt has always persisted; however, the low interest rates and the inability to advance refund existing municipal debt have fueled the growth of these instruments. Depending on the tax-free or taxable rate of return, investors can decide whether these instruments fit in their fixed income portfolio and if it’s worth foregoing the tax-free income to potentially earn higher interest rates.

Furthermore, investors must consult their investment professional and a tax consultant before deciding to purchase these investment instruments.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.